Sometimes we receive a tax invoice and the GST is not equal to 11th or 10% of the Invoice before the GST is added.

In Australia GST is either 10% or 0%.

So, why does it sometimes appear to be different?

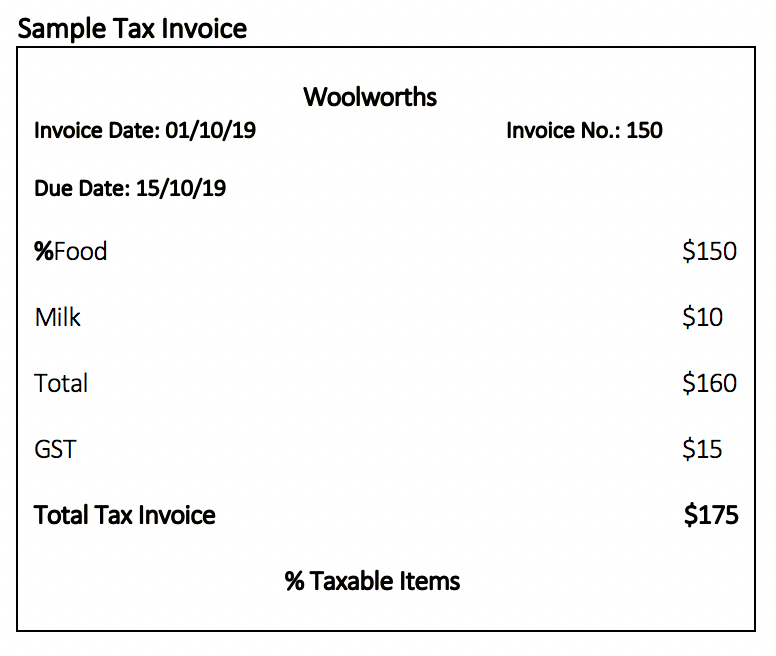

In this example receipt from (say) Woolworths, the total tax invoice is $175 but the GST is only $15.

The total GST is not equal to 10% of the invoice before the GST is added because some items are 0% and some are 10%.

In this example, the Milk is GST free.

Other tax invoices like this are telephone bills where some overseas calls are made. Overseas transactions are GST Free.

Most often the bills are not this simple, and it is difficult to find the items with and without GST.

So how do we enter these bills in our accounting system without spending hours adding small amounts?

We at Benkorp have an easy way to deal with these.

You will love this simple method that can (almost) be entered with no calculators!!

Note: The total tax invoice is not GST inclusive, some items are GST free.

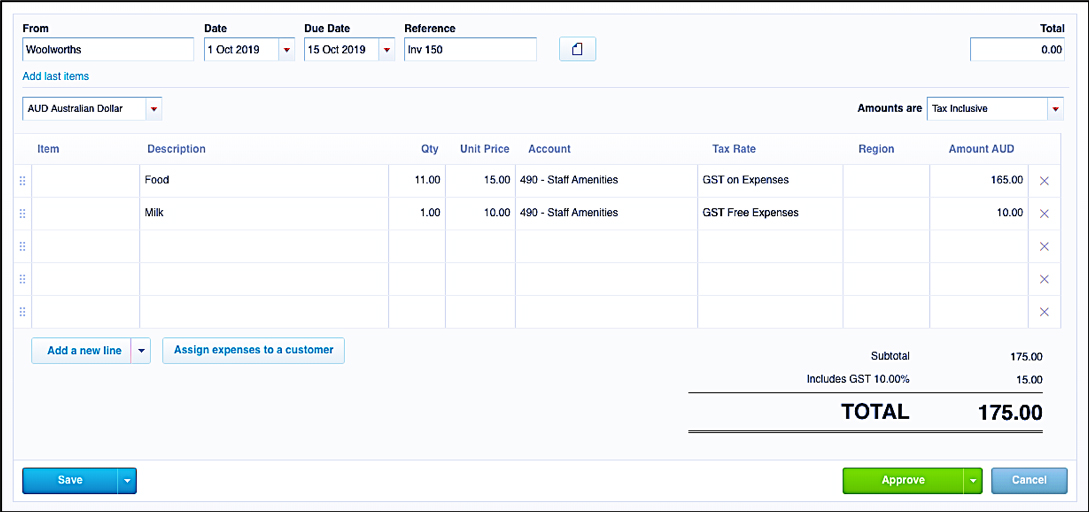

1 – Qty is 11, – I know this sounds strange – but go with me

2 – Total GST in invoice. The total GST in the sample tax invoice is $15.

3 – Tax Rate. The first line refers to the items with GST, please choose GST on Expense.

4 – Calculate the difference the between the Total Tax Invoice less the total of the first line

Formula: ($175 – $165 = $10)

5 – The second line item refers to the items without GST, please choose GST Free for the tax rate.

6 – Check if the GST amount is same with the GST in Invoice.

I hope you like our quick and easy way to enter these transactions!!

Don’t forget to check out our other helpful blogs:

If you have any other ideas or “How-to” questions, the Benkorp team are standing by.