Specialised

Bookkeeping & Accounting

From Our Customers

![]()

Benkorp’s mission is to:

Raise the Standard of Financial Management for His Glory!!

Benkorp’s Bookkeeping & Accounting Services Options

Benkorp has been providing financial management services to Australian Churches & Not for Profits for over 25 years. We’ve developed a well-proven system to ensure effective and efficient financial management.

We can provide full bookkeeping & accounting services or share the role with staff or volunteers within your church/organisation.

FULL Bookkeeping & Accounting services

Process all supplier & reimbursement payments – choose weekly, fortnightly or monthly – with your signatories’ approvals

Payroll – process payroll for your employees, regular STP lodgements & annual finalisations, Worker’s Compensation calculations, organising employee payments.

Compliance – Calculate and submit IAS/BAS

Year-End Audit preparation – reconcile and prepare all year end reconciliations & documentation for your audit/assurance review including liaising with your auditor/reviewer as required

Bookkeeping – enter all transactions in Xero Accounting Software and reconcile your bank and credit card accounts – choose weekly, fortnightly or monthly

Reporting – Produce reports for your wardens/elders/management/board meetings – choose monthly and/or quarterly

Budget preparation assistance if required

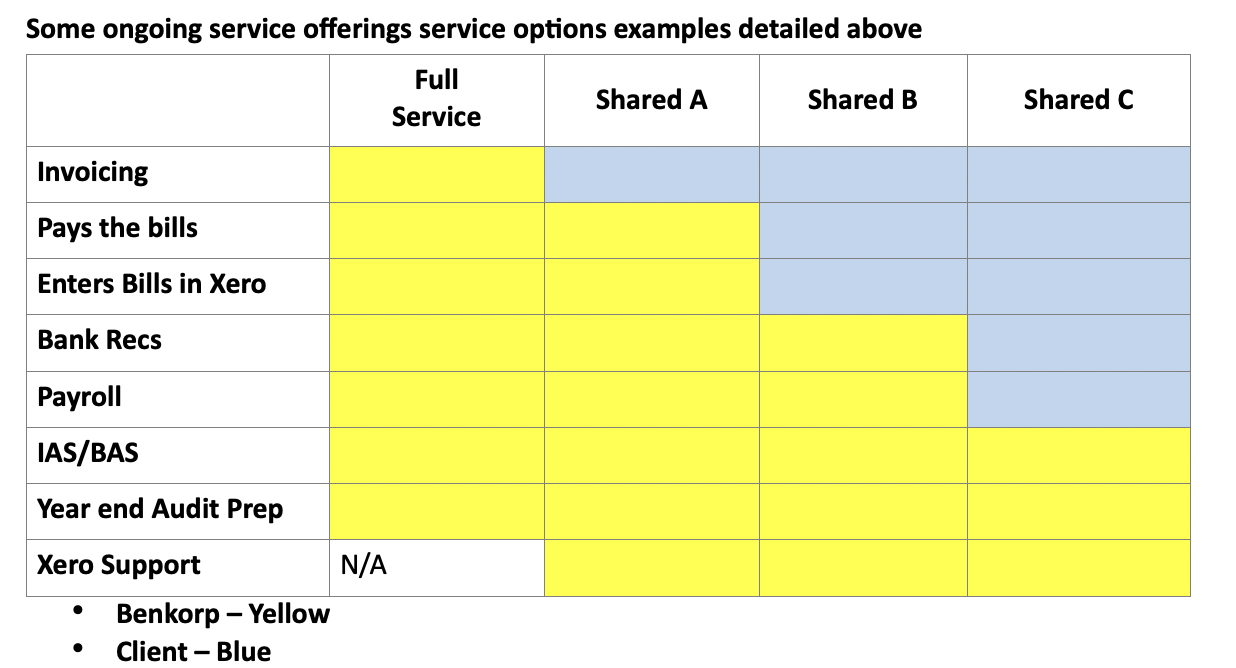

SHARED Bookkeeping & Accounting services

Some churches have staff or volunteers who perform some of the bookkeeping and/or accounting work and contract Benkorp to perform the remaining tasks.

Here are some examples of shared roles:

EXAMPLE A

Organisations with competent administrative staff may organise for the payment and bookkeeping of supplier bills and reimbursements, and have Benkorp perform the remaining tasks. Benkorp also provides training, support and backup for the staff member

EXAMPLE B

Organisations with rented halls or facilities and administrative staff, often prefer their admin person to take responsibility for billing and collections around these rentals and leave Benkorp to perform the remaining tasks

EXAMPLE C

Compliance only – some churches have adequate staff/volunteers who can perform the bookkeeping & payroll services and prefer to outsource the ATO compliance work and year end audit preparation. Benkorp also provides training, support and backup for these staff members/volunteers.

Service Options Packages

Full Service

You send information to Xero

Benkorp does everything else for you:

Benefits of Full Service

- No need to manage the HR requirements, & hire & train qualified bookkeeping and accounting staff etc – see the list in the benefits of Benkorp’s ongoing bookkeeping page

- Enjoy the Full benefits

Shared Pay bills

You pay the bills and send the documentation to Benkorp to process in Xero

Enjoy all other the full-service items

Benefits of No Xero

- No need to hire & train staff etc – see the list in the benefits of Benkorp’s ongoing bookkeeping page

- Enjoy the Full benefits

Disadvantages of No Xero

- You have to enter and process the payments in the bank manually

Shared Bank Reconciliation

.You produce and send the invoices to customers from Xero.

You enter bills in Xero and process payments in the bank.

You reconcile all bank transactions

Benkorp provides initial training & ongoing support

Enjoy all other the full-service items.

-

Benefits of Shared Bank Rec

- Great to produce and send invoices when you want to.

- Works well when you have a good admin person with some finance experience already working for you

- Enjoy all other Full benefits

- Reduces the price

Disadvantages of Shared Bank Rec

- You need to hire or find and manage admin staff

- Difficulty in finding temps when your staff are on holidays or sick

Review & Support

You

- Do all financial management processing and management work

Benkorp

- Completes a review of the accounts for the month each month

- Provides a report of completion and highlights any accounts or processes to be corrected

- Up to 1.5 hours per month, recommended min 3 months for continuity and coordinating with your team

Benefits of Review & report

- Reduces the price

- You have support from our Team who know church accounts

- Our teams work together to ensure effective financial management for your church

Disadvantages of Review & report

- You need to hire or find and manage good finance staff/volunteer

- Difficulty in finding temps when your staff are on holidays or sick

Shared AR

You produce and send the invoices to customers

Benkorp provides initial training & ongoing support

Enjoy all other the full-service items

Benefits of Shared AR

- Great to produce and send invoices when you want to.

- Works well when you have a good admin person already responsible for property bookings

- Enjoy all other Full benefits

- Reduces the price

Disadvantages of Shared AR

- You need to hire or find and manage and train admin and accounts staff.

- Difficulty when staff are on holidays or sick

Shared AR/AP

You produce and send the invoices to customers from Xero

You enter bills in Xero and process payments in the bank

Benkorp provides initial training & ongoing support

Enjoy all other the full-service items

Benefits of Shared AR/AP

- Great to produce and send invoices when you want to.

- Works well when you have a good admin person already working for you

- Enjoy all other Full benefits

- Reduces the price

Disadvantages of Shared AR/AP

- You need to hire or find and manage admin staff

- Difficulty in finding temps when your staff are on holidays or sick

Review & Compliance

You

- produce and send the invoices to customers from Xero

- enter bills in Xero and process payments in the bank

- reconcile all bank transactions

- manage & process payroll

- Produce Monthly reports

Benkorp

- review the accounts and processes

- compliance work (IAS/BAS) & prepare for audit

Benefits of Review Compliance

- Great to produce and send invoices when you want to.

- Works well when you have a finance person on staff

- Enjoy all other Full benefits

- May reduce the fee from full service

- Our teams work together to ensure effective financial management for your church

Disadvantages of Review Compliance

- You need to hire or find and manage good finance staff

- Difficulty in finding temps when your staff are on holidays or sick

Assurance Review Service

Bookkeeping & Accounting Services Agreement Responsibilities

Accounts Receivable

| Frequency | Church/Parish Responsibility | Benkorp Responsibility |

| As agreed | Inform Benkorp of ongoing agreements eg Residential & Commercial rent & licenses | Set up in accounting system for automatic invoicing |

| Forward details of adhoc invoicing required using Benkorp Invoice request form for casual bookings eg Weddings, Funerals | Process in the accounting system and email Customer Invoices as required | |

| Email Weekly completed offering/collection forms to Benkorp | Process in the accounting system | |

|

Allocate receipts to invoices and enter other monies received as per bank statement or banking notification Allocate all invoices/receipts to relevant departments, properties, missions, fundraising as required |

||

| Ultimate responsibility for debt collection Contact customer and negotiate as required | Assist with follow up with customer for debt collection – see process for this below | |

| Produce Accounts Receivable reports directly from Xero as required |

Accounts Payable

| Frequency | Church/Parish Responsibility | Benkorp Responsibility |

| Weekly, Fortnightly, or Monthly as per agreement | Supplier Invoices, approved for payment, scanned by your church and emailed to Benkorp as agreed | Process in the accounting system |

| Approve payments online banking | Enter into your online banking in preparation for your approval & payment | |

| Notify Benkorp of any payments made by cheque or directly | Enter other payments | |

| Send Benkorp completed Minister’s Expense GST Claim form (see below) | Process in the accounting system | |

|

Reconcile bank accounts – import transactions from your bank accounts if required. Allocate all payments to relevant departments, properties, missions, fundraising as agreed |

Payroll

| Frequency | Church/Parish Responsibility | Benkorp Responsibility |

| Fortnightly or monthly as agreed | Inform Benkorp of details of new employees or changes to existing employee details using Benkorp Forms – see below | Set up new employees, process changes to existing employees as required |

| Employees enter & managers approve Leave requests and timesheets using Employee Portal – see details below | Process approved leave requests and timesheets | |

| Approve payments online banking as required |

Process payruns – Email payslips to employees. Upload Payroll and minister’s expense account details to bank account if required and notify bank signatories |

|

| Monthly or quarterly as agreed | Organise for lodgment & payment of Superannuation monthly using Auto Superannuation Function | |

| Annually |

Reconcile Payroll, Produce & email annual Payment Summaries Calculate and submit Workers Compensation documents |

|

| Notify Benkorp using of annual payroll reviews/adjustments using Benkorp Forms | Assist with and process annual payroll reviews/adjustments |

Reporting, BAS & Annual Processes

| Frequency | Church/Parish Responsibility | Benkorp Responsibility |

| Monthly – specific date as agreed | Finalise Bank & other reconciliations | |

| Review Reports, ask questions, recommend changes if required. | Produce & send monthly reports as agreed:

|

|

| Monthly or Quarterly |

Calculate & Lodge IAS/BAS Notify bank signatories of payments if required |

|

| Annually |

Appoint Auditor Lead Budget process |

Assist with audit process Assist with Budget process |

Interested? Our team are ready to Chat with you about how we can assist you.