Being responsible for the financial management of organisations and responsible to the members of the church or other stakeholders, we should always strive to reduce any risk of possible fraudulent activities, where people may deliberately change the banking details or amounts paid.

Background

One of the great time-savers that has been around for quite a while is creating a batch payment and uploading the amounts into many online banking platforms.

The Australian banking system, Xero, and other accounting systems make this very easy. These processes help limit the risk of transposition errors, including bank details and payment amounts. However, responsibility and control are still paramount for the people leading your finances.

The bill paying process using Xero

Xero enables us to:

- Enter the banking details in the Contact record of the payee;

- Enter a bill or reimbursement to be paid;

- Attach the documentation to the Bill/Purchase;

- Select multiple bills to be paid and create a batch payment file (ABA format); and

- Import the ABA file into the online banking platform for bulk authorisation and payment.

The ABA file includes the:

- Supplier/Payee’s bank details (from the Contact record of the payee);

- The amount to be paid; and

- Reference details.

The signatories or Authorised person responsible for online payment should not need to review every BSB & Account number, however occasional double-checking is recommended.

Our recommendations

- Use the Xero user Bank Account Admin option

- Check the banking details for any new Payee

- Perform spot checks

1. Use the Xero user Bank Account Admin option

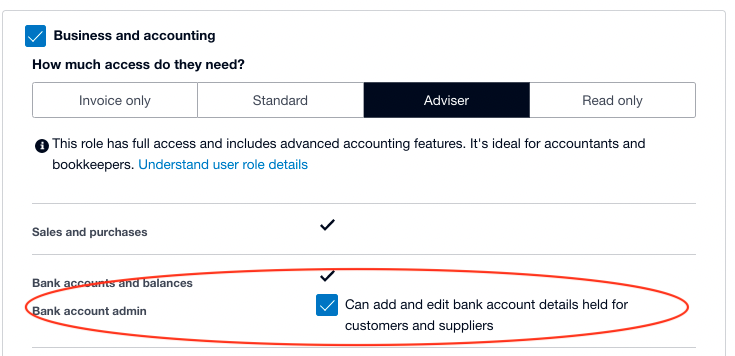

Within Xero using the manage users permission function, you can give users the bank account admin permission to add or edit bank account details for a particular contact.

Users who create batch payments need this permission to add or edit supplier bank account details.

Click here for more details about this in Xero.

2. Check the banking details for any new Payee

When authorising payments online, double-check the bank details of any new payees with the documentation for that payee before the first payment is authorised.

3. Perform Spot Checks

When authorising payments online, occasionally double-check the bank details of payees. Making sure large or unusual amounts are checked. If possible, keep a record using screenshots of the transactions you have double-checked.

Being mindful of risks around this area of payments is both recommended and essential. Taking the steps described above will help mitigate the risk of paying the incorrect amount or paying the wrong supplier whether it is intentional or unintentional.

Got Questions?