FAQ’s for Payment Summaries

These are some of the most commonly asked questions about payment summaries.

If you can’t see an answer to your question, please feel free to contact us and we’ll be happy to help.

Q. How do you do a payroll reconciliation for 1st July to 30th June?

Here are the main steps to process your Payroll Year End: Click Here for PDF version of this process

- Make sure that all pay runs for the year have been processed

- Reconcile the Bank account used to pay the wages

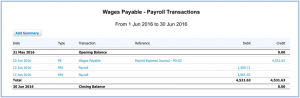

- Check that the Payroll Clearing or Wages Payable Account is zero

- Reconcile payroll reports to general ledger – The purpose of this step is to increase the likelihood that all pays have been processed through the payroll system and the annual Payment Summaries will be correctFirst see this video: https://help.xero.com/au/PayrollEOFY

Run the Payroll Employee Summary Report for the year & export into a spreadsheet

| Payroll Employee Summary | ||||||

| From 1 July 2015 to 30 June 2016 | ||||||

| Employee | Earnings | Deductions | Tax | Super | Net Pay | |

| Employee 1 | $74,951.82 | $36,813.84 | $4,680.00 | $0.00 | $33,457.98 | |

| Employee 2 | $38,305.40 | $0.00 | $4,744.00 | $3,638.93 | $33,561.40 | |

| Employee 3 | $85,310.71 | $49,079.70 | $4,104.00 | $10,807.02 | $32,127.01 | |

| Employee 4 | $88,442.45 | $48,397.44 | $5,328.00 | $0.00 | $34,717.01 | |

| Employee 5 | $48,143.66 | $23,766.59 | $1,872.99 | $7,883.40 | $22,504.08 | |

| Total | $335,154.04 | $158,057.57 | $20,728.99 | $22,329.35 | $156,367.48 | |

Total these. The total must equal to the totals from the Payroll Employee Summary

| 63610 Admin Salaries | $38,755.27 | ||||

| 61150 MEA Entitlements | $158,057.57 | $158,057.57 | |||

| 61110 Ministers Wages | $148,697.31 | ||||

| Leave Accruals | ($9,906.25) | ||||

| Leave Accruals | ($449.86) | ||||

| 63620 Admin Super | $5,248.01 | ||||

| 61170 Ministry Super | $17,081.34 | ||||

| 21330 PAYG Payable | $20,728.99 | ||||

| Total | $335,154.04 | $158,057.57 | $20,728.99 | $22,329.35 |

Run the Payment Summary Details Report as at June 2016

| Employee | Gross Payments | PAYG |

| Employee 1 | $38,137.00 | $4,680.00 |

| Employee 2 | $38,305.00 | $4,744.00 |

| Employee 3 | $36,231.00 | $4,104.00 |

| Employee 4 | $40,044.00 | $5,328.00 |

| Employee 5 | $24,376.00 | $1,872.00 |

| Total | $177,093.00 | $20,728.00 |

Compare the Gross Payments to Earnings – Deductions

$335,154.94 – $158,057.57 = $177,097.37

– Difference is $4.37 – This is acceptable as the cents are removed from Gross Payments

-

Send & lodge the Payment Summaries

Q. What is the process in issuing annual payment summaries?

We do a payroll reconciliation for the 1st July to 30th June and then prepare the payment summaries.

1. How do we do a Payroll Reconciliation for the 1st July to 30th June? (Verify the payroll data matches the general ledger)

Check out the video instructions below.

2. Prepare employee Payment Summaries and send to employees by 14th July

- In employee area of Xero click ‘Payment summaries’

- Add name and contact details of person whose name is to appear on the Payment Summaries

- Do not click FBT Exemption if you are a church or not for profit

- Choose the correct financial year

- FBT figures (from Fringe Benefit tax return) or lump sum figures are added manually.

Lump Sum amounts decrease the gross payment amount.

- Select all and publish

- They are now available in the MY Payroll portal for staff

- You can also email or print the payment summaries.

3. Submit Payment Summaries to the ATO by 14th August

- Select all

- Click ‘File Now’

- Top righthand changes to ‘pending’ and then once processed ‘accepted’.